Lump.Finance

Lump Finance is a decentralized-support platform that allows content creators to receive funding from their fans while significantly reducing the financial burden for the fans

Project Description

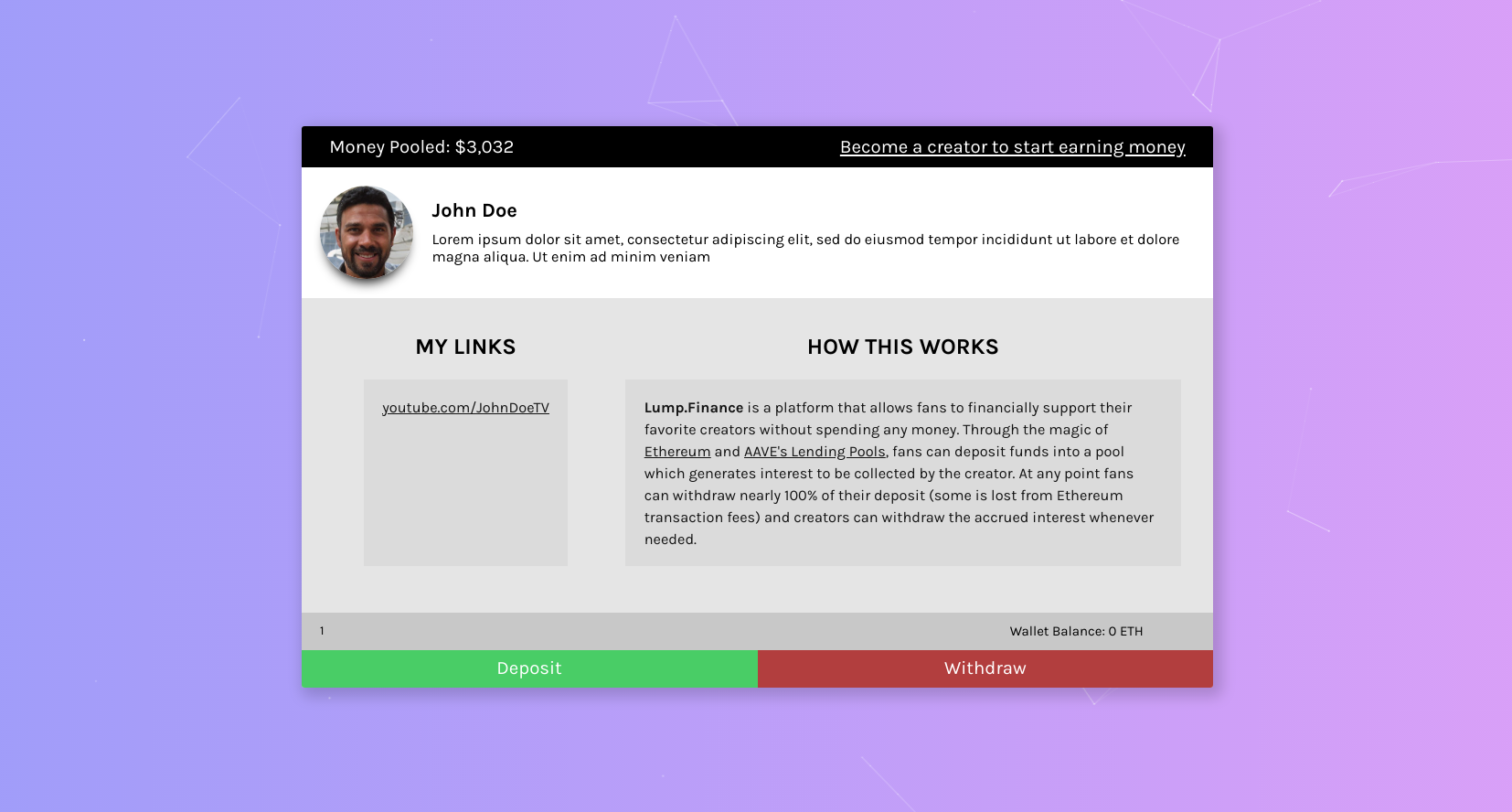

Lump.Finance is a platform that lets content creators receive financial support from their fans by collecting the accrued interest generated by a pool of money that holds deposits from fans. This introduces a unique and decentralized way for creators of any kind to receive funding from their fans while significantly reducing the financial burden for the fans. The simplified process is as follows:

-

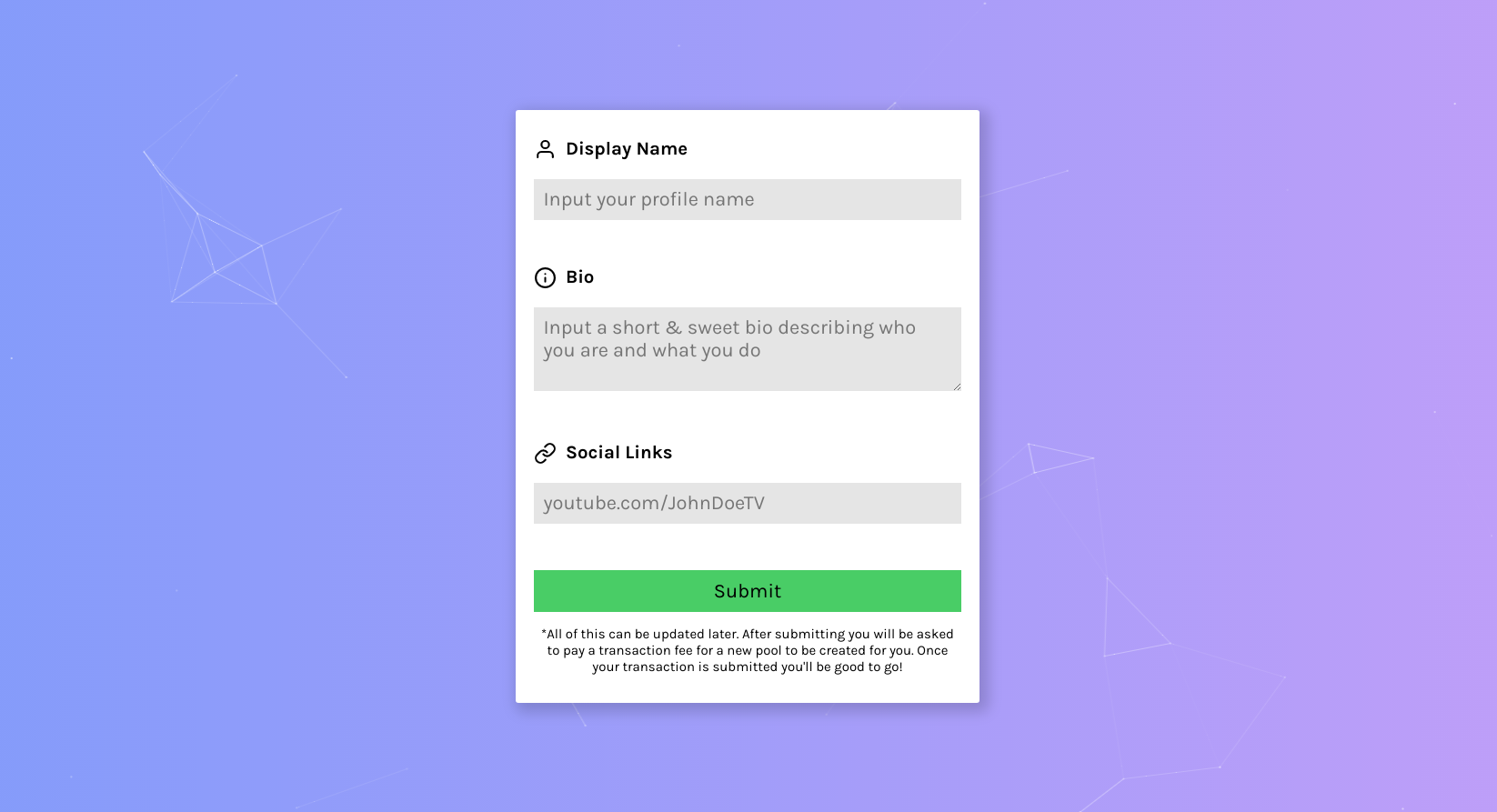

Content creators visit Lump.Finance to create a new pool that fans can ~lump~ their money into.

-

When a fan wants to support their content creator they visit Lump.Finance to view the creator's page. From their they can deposit Ethereum into the pool. Their deposited Ethereum is swapped to DAI and deposited into Aave's DAI lending pool.

-

Over time the deposited DAI in the creator's pool will generate interest and begin to compound.

-

At any point the creator of the pool can withdraw the accrued interest but has no access to the deposits from the fans.

-

When a fan decides to take out their money they will receive nearly 100% of their deposit back as some is lost to gas fees.

How it's Made

The detailed process:

-

Content creators visit Lump.Finance to create a new pool. This triggers PoolFactory.sol to deploy a new Pool.sol contract which will serve as a pool that fans can deposit Ethereum into. From this point on, all interactions between creators and fans will be done through the new Pool.sol contract.

-

When a fan wants to support their content creator they visit Lump.Finance to view the creator's page. From their they can deposit Ethereum into the pool. This triggers the creator's Pool.sol to swap the Ethereum to DAI using Uniswap then deposit it into Aave's DAI lending pool. In return the pool receives newly minted aDAI at a 1:1 ratio to the deposited DAI.

-

Over time the aDAI in the creator's Pool.sol contract will generate interest based on the amount of aDAI currently in the pool and will begin to compound. Aave's DAI lending pool. As of this writing (Feb. 6, 2021) Aave's DAI lending pool has had an average APY% of 9.49% over the last 30 days. The USDT pool has an average 30 day APY% of 11.51% and sUSD has an average of 16.35%. Right now the contract only swaps the Ethereum to DAI but I have plans on changing this to dynamically swap and deposit into the pool with the highest APY.

-

At any point the creator of the pool can withdraw the accrued interest but cannot touch the aDAI deposited by fans. Currently when the creator can only withdraw in DAI but I plan on adding the feature to choose what token to be paid in.

-

When a fan decides to take out their money they will receive nearly 100% of their deposit back as some is lost to gas fees. Swapping to and from DAI and depositing/withdrawing into the Aave's pools will take from the initial deposit but the overall idea is to offer creators and their fans a way to give support while significantly reducing the financial burden.

Technology Used:

-

React : frontend

-

Typescript : cleaner code

-

Firebase : user profiles

-

Hardhat : solidity contracts

What's Next:

-

Improve contract efficiency to reduce on gas fees

-

Uniswap is used for swaps instead of 1inch

-

Dynamically deposit Aave pool that has the highest APY

-

Popup dialogues for showing the progress of transactions

-

Allow creators/fans to deposit and withdraw in any ERC20 token

-

Profile pictures

-

Visual representation of current APY based on how much is deposited in the pool